The tourism and hospitality industry in Singapore is vibrant and dynamic, attracting businesses and travelers from around the world. However, when it comes to collecting debts within this sector, understanding the local system and practices is crucial for effective recovery. This article delves into the debt recovery process specific to Singapore’s tourism and hospitality services trade, providing insights into the legal framework, costs, and best practices for creditors.

Key Takeaways

- Singapore’s debt recovery in tourism and hospitality involves a three-phase system, with initial actions taken within 24 hours of account placement and daily contact attempts.

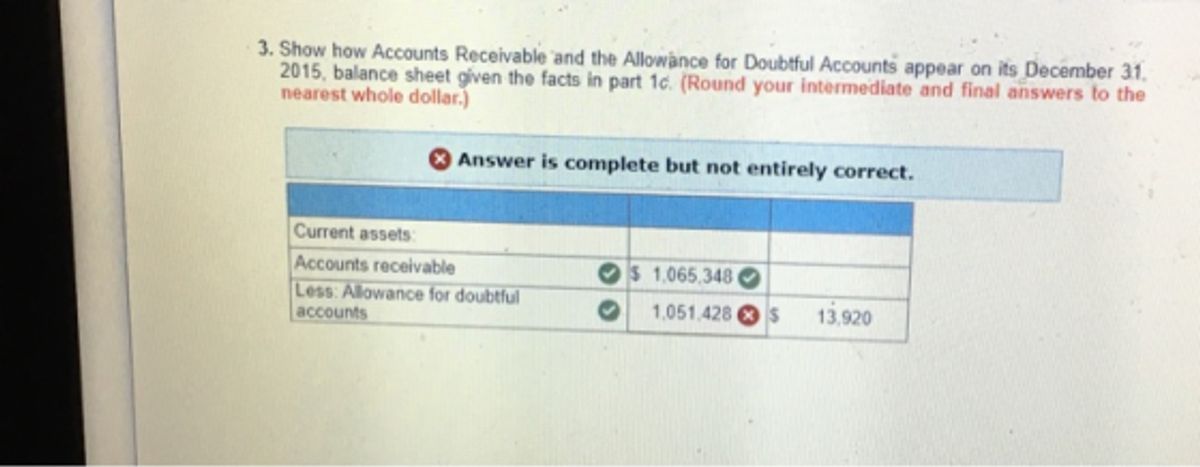

- Local attorneys are engaged for debt recovery, drafting legal notices, and maintaining persistent communication, while evaluating the potential for litigation.

- The litigation process requires careful decision-making due to associated costs, which typically range from $600 to $700, and understanding the financial implications of legal outcomes.

- Debt collection service fees vary based on the number of claims, age of accounts, and whether legal action is required, with rates ranging from 27% to 50% of the amount collected.

- Creditors are advised to implement proactive debt management strategies, maintain accurate records, and work closely with collection agencies and legal teams to optimize recovery efforts.

Understanding the Debt Recovery System in Singapore’s Tourism and Hospitality Sector

Overview of the Three-Phase Recovery System

The Three-Phase Recovery System is a structured approach to securing payments from debtors in Singapore’s tourism and hospitality sector. Phase One initiates within 24 hours of account placement, involving multiple contact methods and daily attempts to reach a resolution. If unsuccessful, the case escalates to Phase Two, where legal muscle is flexed through attorney-drafted letters and persistent communication efforts.

In Phase Three, the path diverges based on a thorough investigation of the debtor’s assets and the likelihood of recovery. Closure or litigation are the two stark outcomes, with associated costs and decision-making resting on the creditor’s shoulders.

The fee structure for debt collection services is competitive and varies depending on claim quantity and age. It’s crucial for creditors to understand these rates as they directly impact the cost-effectiveness of the recovery process.

Initial Actions within 24 Hours of Account Placement

The clock starts ticking immediately after an account is placed for recovery. Within the first 24 hours, a series of strategic actions are initiated to ensure the best chance of debt resolution. A debtor will receive the initial communication, marking the beginning of persistent outreach efforts.

- The first of four letters is dispatched via mail, setting the tone for the recovery process.

- Comprehensive skip-tracing and investigations are conducted to gather optimal financial and contact information.

- A dedicated collector begins daily attempts to engage the debtor through various channels: phone, email, text, fax, and more.

The goal is clear: establish contact and negotiate a resolution swiftly. If these efforts do not yield results, the case escalates to Phase Two, involving legal intervention.

The urgency of these actions cannot be overstated. Timely outreach and negotiation are crucial for successful debt recovery, as highlighted in the in-depth guide on debt recovery in Singapore’s tourism and hospitality sector.

Daily Contact Attempts and Transition to Phase Two

Persistence is key in the initial phase of debt recovery. Daily contact attempts are made through various channels, aiming to secure a resolution. If these efforts do not yield results within 30 to 60 days, the process transitions to Phase Two. This phase intensifies the pressure on the debtor, with the case handed over to a local attorney. The attorney’s involvement escalates the seriousness of the situation, as they begin with drafting demand letters and making direct calls.

The transition to Phase Two signifies a strategic shift, leveraging legal expertise to reinforce the urgency of debt repayment.

The table below outlines the transition criteria and actions taken:

| Phase | Duration | Actions |

|---|---|---|

| One | 30-60 days | Daily contact via calls, emails, texts |

| Two | Immediate upon transition | Legal notices and calls by attorney |

The debt collection process in Singapore involves initial communication, legal escalation if needed, and strategic assessment for resolution. Local expertise and technology are key for successful collections.

Legal Interventions in Debt Collection

Engaging Local Attorneys for Debt Recovery

In the intricate landscape of Singapore’s tourism and hospitality sector, engaging local attorneys is a pivotal step in the debt recovery process. These legal professionals bring to the table not just their expertise in law, but also a deep understanding of the local culture and technological tools that are instrumental in navigating the complexities of debt collection.

- Local attorneys initiate action with authority, compelling debtors to respond promptly.

- A structured approach by legal experts often leads to more favorable outcomes.

- The attorney’s involvement signifies a shift from soft collection tactics to a more formalized legal stance.

Engaging local legal expertise, cultural understanding, and technology are key for successful debt collection in Singapore. Attorneys enhance collection efforts through legal authority and structured approaches, ensuring prompt debtor responses and favorable outcomes.

When the decision to litigate is made, creditors face upfront legal costs, which typically range from $600 to $700. This investment activates the legal machinery, empowering attorneys to pursue all owed monies vigorously. It’s a calculated move, with costs balanced against the potential for significant recovery.

Drafting Legal Notices and Persistent Communication

Once an account enters Phase Two, the focus shifts to legal notices and relentless communication. The appointed attorney drafts a series of formal letters, each escalating in tone, to signal the seriousness of the debt recovery process. Daily attempts to contact the debtor are made through calls and written correspondence, ensuring the debtor is aware of the impending legal consequences.

The goal is to secure payment or reach a resolution before escalating to litigation, minimizing additional costs and preserving business relationships.

The process is systematic and persistent, with the attorney’s involvement adding legal weight to the demands. This phase is critical in the recovery system, as it often determines the course of action—whether to proceed with litigation or to close the case.

Evaluating the Case for Litigation or Closure

When the time comes to decide the fate of a debt recovery effort, two paths emerge: closure or litigation. Closure is recommended when asset investigation suggests low recovery likelihood—owing nothing for such advice. Conversely, choosing litigation necessitates upfront costs, typically $600-$700, covering court and filing fees.

Deciding against legal action allows for claim withdrawal or continued standard collection efforts without additional charges.

Should litigation proceed and fail, the case closes without further financial obligation. It’s crucial to weigh the potential return against the costs and chances of successful debt recovery.

Fee Structure for Litigation Cases:

| Claims Quantity | Accounts < 1 Year | Accounts > 1 Year | Accounts < $1000 | Attorney-Placed Accounts |

|---|---|---|---|---|

| 1-9 | 30% | 40% | 50% | 50% |

| 10+ | 27% | 35% | 40% | 50% |

The fee structure varies based on claim quantity and age, with a 50% rate for accounts requiring legal action. This information aids in making an informed decision on whether to litigate or close the case.

The Litigation Process and Associated Costs

Decision Making for Legal Action

When faced with the decision to initiate legal action, creditors must weigh the potential for debt recovery against the upfront costs. Careful consideration is crucial as litigation is not always the most viable option. If the investigation suggests low recovery chances, closure is advised, incurring no fees.

Should you opt for litigation, expect to cover initial legal expenses, typically $600 to $700. These include court costs and filing fees. A lawsuit will be filed to recover all monies owed. However, if litigation does not result in debt recovery, the case will be closed with no additional cost to you.

The choice to litigate should be informed by a thorough assessment of the debtor’s assets and the facts of the case.

Here’s a quick overview of the fee structure for accounts placed with an attorney:

- Accounts under 1 year: 30% (1-9 claims) or 27% (10+ claims) of the amount collected.

- Accounts over 1 year: 40% (1-9 claims) or 35% (10+ claims) of the amount collected.

- Accounts under $1000: 50% of the amount collected.

- All accounts requiring legal action: 50% of the amount collected.

Understanding Upfront Legal Costs and Fees

Before initiating litigation, creditors must be cognizant of the upfront legal costs. These costs are a pivotal factor in the decision-making process for pursuing delinquent accounts in the tourism and hospitality sector.

Upfront costs typically range from $600 to $700, depending on the jurisdiction of the debtor. This fee covers court costs, filing fees, and other related expenses. Creditors should weigh these costs against the potential recovery from the debtor.

The evaluation of recovery rates versus legal costs is crucial for a strategic approach to debt recovery.

Here is a succinct breakdown of the potential upfront legal fees:

| Jurisdiction | Court Costs | Filing Fees | Additional Expenses |

|---|---|---|---|

| Local | $300 | $200 | $100 |

| Regional | $350 | $250 | $100 |

Creditors should also consider the collection rates when deciding on litigation. The rates vary based on the age and quantity of claims, as well as whether the account requires legal action.

Outcomes of Litigation and Financial Implications

When litigation is pursued, the financial stakes are high. Win or lose, the costs are real. Clients must weigh the potential recovery against the expenses incurred. Upfront legal costs, such as court fees and filing charges, typically range from $600 to $700, depending on the debtor’s jurisdiction.

Success in litigation may mean recovering the full debt plus associated legal costs. However, failure to collect via litigation leads to case closure with no additional fees owed to the firm or affiliated attorney. It’s a gamble where the creditor must assess the debtor’s ability to pay.

The decision to litigate is pivotal, with outcomes ranging from full recovery to case closure without further obligation.

Here’s a snapshot of the fee structure for accounts placed with an attorney:

- Accounts under 1 year in age: 30% of the amount collected.

- Accounts over 1 year in age: 40% of the amount collected.

- Accounts under $1000.00: 50% of the amount collected.

- Regardless of age or amount, accounts requiring legal action: 50% of the amount collected.

These rates underscore the importance of a strategic approach to debt recovery in the tourism and hospitality sector.

Fee Structure for Debt Collection Services

Competitive Collection Rates and Fee Determination

Determining the right fee structure for debt collection services is crucial for maintaining a balance between cost-effectiveness and quality of service. Competitive rates are tailored to the volume and age of claims, ensuring creditors receive value for their investment in recovery efforts.

Collection rates vary based on several factors:

- The number of claims submitted within the first week of placing the first account.

- The age of the accounts, with different rates for accounts under and over one year old.

- The amount owed, with higher rates for accounts under $1000.00.

- Accounts requiring legal action incur a uniform rate regardless of other factors.

Here’s a quick overview of the rate structure:

| Number of Claims | Accounts < 1 Year | Accounts > 1 Year | Accounts < $1000 | Legal Action |

|---|---|---|---|---|

| 1-9 | 30% | 40% | 50% | 50% |

| 10+ | 27% | 35% | 40% | 50% |

It’s essential to understand that these rates are designed to incentivize early and bulk submissions, which can significantly reduce the cost per claim for creditors.

Remember, the goal is to recover debts efficiently without compromising on the ability to pursue legal avenues when necessary. The fee structure reflects the complexity and resources required for each case, aligning the interests of the collection agency with those of the creditor.

Rate Variations Based on Claim Quantity and Age

Debt collection fees in Singapore’s tourism and hospitality sector are not one-size-fits-all. Rates are structured to reflect the urgency of recovery and the financial implications of the debt. A tailored approach ensures that creditors maximize recovery while minimizing costs.

For instance, volume discounts are applied for multiple claims, incentivizing bulk placements. Here’s a quick breakdown of the fee structure:

| Claims Quantity | Accounts < 1 Year | Accounts > 1 Year | Accounts < $1000 | Attorney Placed |

|---|---|---|---|---|

| 1-9 | 30% | 40% | 50% | 50% |

| 10+ | 27% | 35% | 40% | 50% |

The age of the account is a critical factor, with older accounts typically incurring higher fees due to the increased difficulty in collection.

Remember, the more claims you submit within the initial week, the more favorable the rates. This sliding scale ensures that the collection process is equitable and reflects the complexity and volume of work required.

Additional Fees for Accounts Requiring Legal Action

When legal action becomes necessary, creditors must be prepared for additional costs. Upfront legal fees are a reality of litigation, typically ranging from $600 to $700. These cover court costs, filing fees, and other related expenses. Our strategic approach ensures that if litigation does not result in recovery, the creditor owes nothing further.

Our fee structure is designed to be cost-effective, with rates varying based on the age and quantity of claims. For accounts requiring legal representation, a standard rate of 50% of the amount collected is applied, regardless of the number of claims or their age.

Deciding on litigation is a critical step. We provide clear options and transparent pricing to guide creditors through this process.

Here’s a quick breakdown of our collection rates for accounts placed with an attorney:

- For 1-9 claims: 50% of the amount collected

- For 10 or more claims: 50% of the amount collected

It’s essential to understand these fees when engaging in debt recovery within Singapore’s tourism and hospitality sector.

Best Practices for Creditors in the Tourism and Hospitality Industry

Proactive Debt Management Strategies

To mitigate risks in the tourism and hospitality industry, creditors must adopt proactive debt management strategies. These strategies are not just about pursuing overdue accounts; they involve a comprehensive approach to prevent debts from becoming unmanageable.

Prevention is better than cure. Establishing clear payment terms and conditions upfront can significantly reduce the likelihood of debt accumulation. Regularly reviewing customer creditworthiness and adjusting credit limits accordingly can also safeguard your business’s financial health.

Timely intervention is crucial. At the first sign of payment delay, engage in open communication with the debtor to understand the underlying issues and explore mutually beneficial solutions.

Here’s a quick checklist to keep your debt management on track:

- Conduct thorough background checks on new clients

- Set clear credit policies and enforce them consistently

- Monitor account receivables closely

- Send reminders and follow-ups promptly

By staying vigilant and maintaining open lines of communication, creditors can navigate the complexities of the Singaporean market, ensuring that their financial interests are protected while fostering positive customer relationships.

Maintaining Accurate Records and Documentation

In the realm of debt collection, meticulous record-keeping is non-negotiable. Accurate documentation forms the backbone of a successful recovery process, especially when legal action is a possibility.

Timely updates and comprehensive records are essential for assessing the debtor’s financial status and determining the most effective recovery strategy. This includes logging all communication attempts, payment agreements, and any received payments.

- Record every interaction with the debtor

- Keep copies of all correspondence and agreements

- Update financial records promptly

- Note any changes in the debtor’s circumstances

By maintaining a detailed account of the debt recovery efforts, creditors safeguard their interests and enhance the prospects of a favorable outcome.

Remember, a well-documented case not only supports your position but also streamlines the process for collection agencies and legal teams. It’s a critical step that cannot be overlooked.

Collaborating with Collection Agencies and Legal Teams

Effective collaboration with collection agencies and legal teams is crucial for successful debt recovery in the tourism and hospitality sector. Engage local legal expertise to navigate Singapore’s legal landscape, ensuring compliance and cultural sensitivity. Utilize technology to streamline communication and overcome challenges such as time zone differences.

Collaboration is key:

- Establish clear communication channels with your collection agency.

- Ensure that legal teams are informed of all case developments.

- Share relevant debtor information promptly to facilitate recovery efforts.

By fostering a strong partnership with collection agencies and legal teams, creditors can enhance their chances of recovering outstanding debts while minimizing legal hurdles and cultural barriers.

Remember, a unified approach can lead to more efficient and effective debt collection strategies, ultimately benefiting your business’s bottom line.

Navigating the complexities of debt recovery in the tourism and hospitality industry requires a specialized approach. At Debt Collectors International, we understand the unique challenges you face and offer tailored solutions to ensure your financial stability. Don’t let unpaid debts disrupt your business operations. Visit our website today to learn more about our expert services and take the first step towards safeguarding your revenue. Our experienced team is ready to assist you with effective debt collection strategies that respect your customer relationships while delivering results.

Frequently Asked Questions

What happens within 24 hours of placing an account for debt recovery?

Within 24 hours of placing an account, the first of four letters is sent to the debtor, the case is investigated for financial and contact information, and our collector begins daily attempts to contact the debtor using various communication methods.

What actions are taken during Phase Two of the debt recovery process?

In Phase Two, the case is forwarded to a local attorney who drafts demand letters and attempts to contact the debtor. If these attempts fail, a recommendation is made for either closure of the case or litigation.

What are the possible recommendations at the end of Phase Two?

The recommendations at the end of Phase Two are either to close the case if recovery is unlikely, or to proceed with litigation if there is a possibility of recovering the debt.

What are the upfront legal costs if litigation is pursued?

If litigation is pursued, the creditor is required to pay upfront legal costs such as court costs and filing fees, typically ranging from $600.00 to $700.00, depending on the debtor’s jurisdiction.

How is the fee structure determined for debt collection services?

The fee structure for debt collection services varies based on the number of claims, the age of the accounts, and whether the account requires legal action, with rates ranging from 27% to 50% of the amount collected.

What happens if attempts to collect via litigation fail?

If attempts to collect via litigation fail, the case will be closed, and the creditor will owe nothing to the firm or the affiliated attorney for these results.